You may or may not be familiar with the term US exceptionalism, this is distinct from “American exceptionalism” I might add and only a financial term. In a nutshell it is the concept that US assets look more attractive than those outside of the US, which leads to inflows from the rest of the world i.e. other emerging AND developed markets and subsequently leads to USD strength.

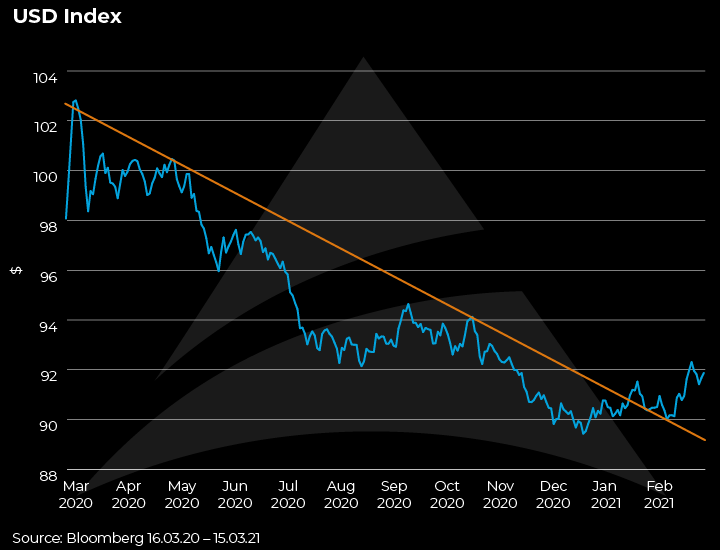

Betting against US exceptionalism was one of the most popular trades of the last year, based on the fact that the virus was out of control in the US, divisive elections were due, stimulus was proving a struggle and rates were lowered in the US to broadly match those in other parts of the world.

However, we are undeniably now in the throws of US exceptionalism once again. The huge amounts of fiscal stimulus coming from the Biden administration with the possibility of more to come in the near future from the impending infrastructure bill, as well as a highly successful vaccination program in comparison to much of the rest of the world, leading to a swift opening up. Let’s not forget the huge amounts of built up additional savings in the US (approx. $1.5trn) giving the US consumer the firepower to take advantage of this swift reopening, it’s no surprise the US looks relatively good, especially versus Europe. And an investor in the US gets higher yields too!

What does this mean for US markets?

It not only leads to better short-term performance of US equity markets but shows up in the fixed income markets too. Simply put, it is now possible to earn a much higher yield in US fixed income than it is elsewhere, so for global investors it makes sense to sell the low yielding asset and buy the high yielding one. For many investors, particularly those whose aim is purely to match assets with liabilities and hence lock in relatively safe returns for a long period of time (think insurance companies and pension funds), higher yields in US treasuries are very attractive. As part of this trade, it involves selling the low yielding currency, such as Japanese Yen or Euros and buying a high yielding one, at the moment the USD. This is otherwise known as the “carry trade”. These portfolio flows make for a stronger USD.

Everything now looks rather rosy for the US – massive fiscal stimulus and higher US Treasury yields willing to be financed by the rest of the word through the carry trade and a stronger dollar taking at least some of the inflationary pressure off. Add to this a faster vaccine roll-out and states economically opening up (particularly compared to Europe), then the US will remain exceptional in the near-term.

What about the rest of the world?

However, the flip side of the monetary flows we are seeing at present might be good news for the US but it is bad news for the rest of the world. In particular, the stronger USD effectively leads to monetary tightening in emerging markets because their liabilities are priced in USD – it is no surprise that since the USD has perked up, EM debt and equities have started to underperform. And much the same as the carry trade, relative to EM debt, US Treasuries are also starting to look relatively attractive. Why take all that risk in EM when cash can be parked in US treasuries? Add to this a rebasing in oil from opening up and the outlook for EM in the near term looks relatively tough going.

It is also no surprise the ECB has come out with more aggressive bond buying. Because US fixed income now looks so attractive to these large global buyers of fixed income, the worry for the ECB is these same investors sell European government bonds to buy US treasuries and partake in the carry trade once again, in the process tightening financing conditions in the Eurozone through higher bond yields at a time when on a relative basis, Europe looks quite poorly, because of a botched vaccine rollout.

In short, US assets in all their forms, as well as the USD should continue to outperform in the near term. In addition, as we’ve outlined above, higher US bond yields and a higher USD are not a good mix for assets in the rest of the world, logically we are likely to see a continued underperformance of rest of the world assets versus the US. This dynamic is only likely to snap when US assets and in particular US rates start to look relatively unattractive. We are some way from this happening. Hence we continue to see USD strength and all the subsequent ramifications for the foreseeable future.