Lloyd Harris, Premier Miton’s Head of Fixed Income, considers potential members of “the inauspicious club of over-levered UK water companies to heap losses on bondholders”.

According to Sky News, Thames Water has lined up court dates to push through its “huge” debt restructuring. We’re looking at the most likely candidate to join Thames in the inauspicious club of over-levered UK water companies to heap losses on bondholders. Who could it be?

As we said in our blog post Thames Water and the Temple of Doom in July, we have felt Thames Water could be heading towards a whopper of a debt restructuring. It is the only way out for a company that has not enough equity, too much debt and is in the process of getting junked by the rating agencies to high yield.

The position the water sector finds itself in is an unfortunate one. A multi-decade failure by the regulator Ofwat to ensure that there is enough investment taking place and that company owners are not taking too much in the way of returns out of the companies. Now we are in a position where the weaker water companies need to reduce leverage and increase capital expenditure at the same time. The answer is either more equity, less debt or water bills have to go up. What is likely in some cases, as we are seeing, is a combination of all three.

Is Southern Water next?

Increasingly this looks like it is Thames Water Mark II. Southern has actually scored lowest for financial resilience (even lower than Thames) and it also has the lowest environmental score. Hence the company is on a solid path to being high-yield rated, clinging precariously to an investment grade rating by the skin of its teeth. Baa3 at Moody’s, for example – another notch lower and the company finds itself in high-yield territory. As with the rest of the sector, the capex need is large, which implies debt issuance over the foreseeable future needs to happen at a good lick. Even at current levels of yield and credit spread, Southern would be unable to fund any capex, and this is before a downgrade to high yield.

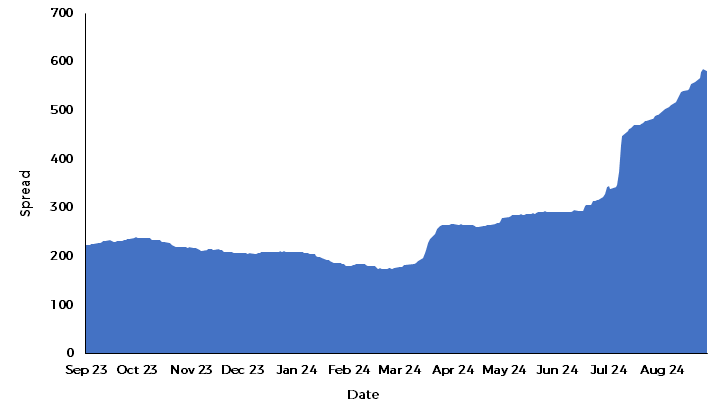

Spread evolution of Southern Water 1.625 03/20/27

Source: Bloomberg 25.09.2023 – 20.09.2024. Past performance is not a guide to future returns.

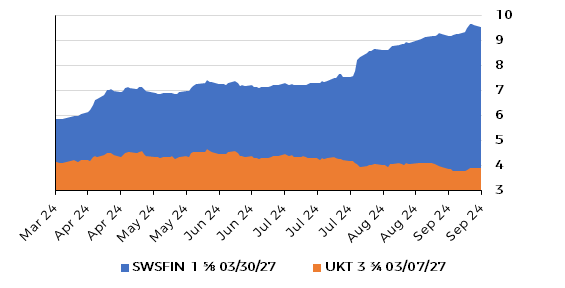

Yield evolution of Southern Water 1.625 03/20/27

Source: Bloomberg, 25.03.2024 – 23.09.2024. Past performance is not a guide to future returns.

A reminder that spread and yield increase = price decrease!

With Southern Water’s debt stack not on the same scale as Thames’, but ultimately still comfortably in excess of £3bn, this will be another fairly large issuer for the high-yield market to absorb. And it suffers from the same issues as Thames when falling to high-yield – lots of long-dated debt that high-yield investors are not particularly keen on.

The trip to high yield is likely to be fleeting, though. A restructuring will no doubt be in the offing sooner rather than later which will put the company on a more sustainable and certainly more investable path. For a high-yield water company, the only option is to restructure the debt. More equity is not at all possible at these levels of debt financing and water bills just can’t go up enough to save the company. And indeed, why should they?

Lloyd Harris

Head of Fixed Income, Premier Miton Investors