For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

European Watchdog Discusses AT1 Reforms

According to Bloomberg yesterday (17/05/2023), the European Banking Authority has been holding talks on ways to boost investor interest in the AT1 market after Switzerland’s shock decision to wipe out $17bn of Credit Suisse notes.

The article suggests ideas include requiring dividend payments to be shut off before AT1 coupons (effectively a form of dividend stopper that used to exist on Tier 1 instruments in the past) or the potential for cumulative coupons (currently not allowed). Whilst the article goes on to suggest the EBA does not feel the need to put these changes in place at the moment, we see the discussion by the regulator as very supportive for the AT1 market. The market reacted in a similarly positive fashion. Let’s face it, it’s nice to know the regulator has your back as an investor and is willing to entertain investor friendly outcomes!

As we suggested in a previous blog (Unicredit to early redeem EU 1.25bn AT1 subordinated notes), regulators around the world came out in support of this asset class post the Credit Suisse debacle and were explicitly distancing themselves from the actions of the Swiss. We also noted how in the past, the European regulator had bemoaned the cost of capital for European banks in comparison to their US counterparts. Clearly it is highly undesirable for the cost of AT1 issuance for European banks to go up further. The Bloomberg article suggests the European regulator is still thinking along these lines and is keen to promote normal market functioning as well as making the asset class as attractive as possible to investors.

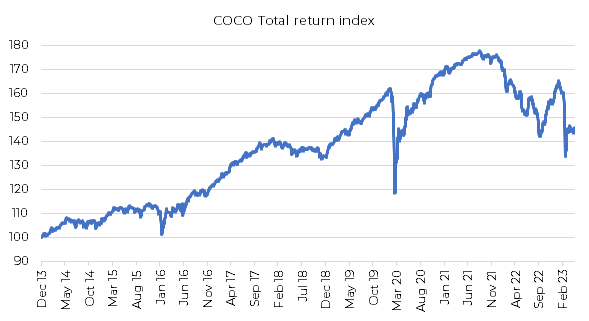

We continue to see a solid recovery in contingent capital which supports our thesis that whenever there are significant drawdowns in the asset class, it’s an excellent entry point.

Source: Bloomberg 31.12.2013 to 17.05.23