For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

This time last year I wrote about the short end of the yield curve – those fixed income securities with short maturities and reduced price risk from movements in interest rates because of their very short duration. The Premier Miton UK Money Market Fund focuses on these types of fixed income assets, those with strictly less than a year to maturity and in some cases much less, such as overnight and 1 week deposits.

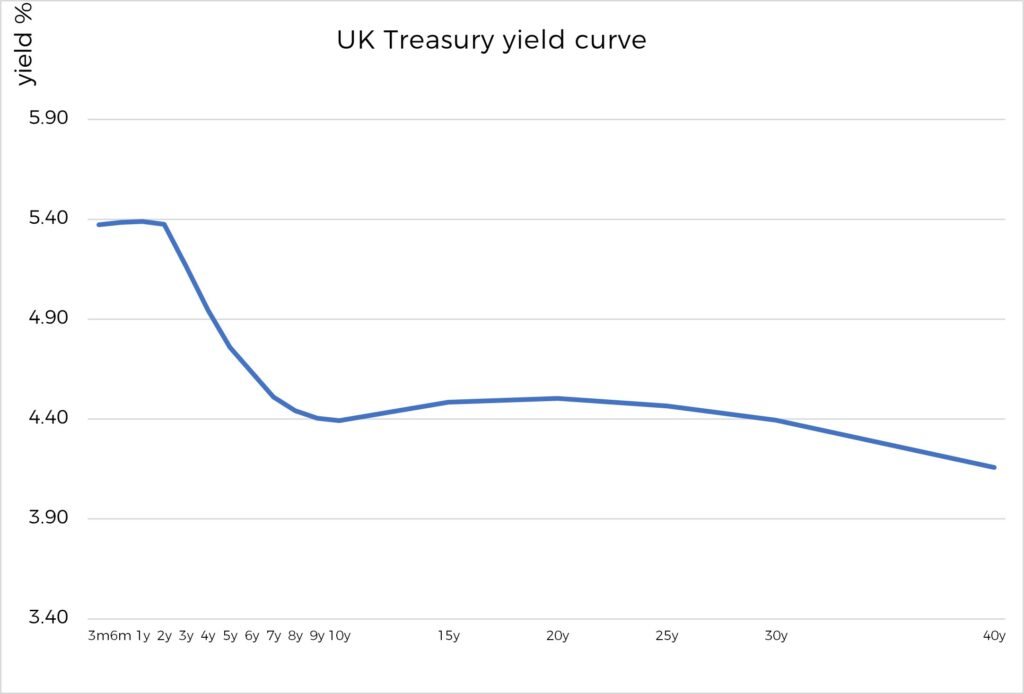

With the Bank of England raising interest rates once again last month, higher base rates are making fixed income ever more attractive. What is also making this particular part of the fixed income market quite so attractive is the shape of the yield curve in the UK:

Source: Bloomberg as at 03.07.23

It’s extremely inverted out to the 7 year point. Any investments with a year to maturity or less are yielding more than any other point on the curve. Hence we get paid the most with the least amount of price risk. There is a compelling argument to be at the short end of the curve especially when you consider the Premier Miton UK Money Market Fund B income unit class yields 5.40% for both the distribution and underlying yield* as at the end of June with a 77 day weighted average life.

Indeed, when we reflect on why the curve is this shape, it is monetary policy at work. In order to tame inflation, central banks around the globe want less investment in order to reduce the amount of activity in their economies. This will lead to lower rates and less economic growth in future. Part of this process is incentivising investors to take on less risk by parking cash at the place with the best risk adjusted return – the short end of the curve. And not in riskier investments.

Whilst we think we’ll continue to see more interest rate rises in the UK from the current 5%, we are of the opinion we are reaching the end of the tightening cycle. Against this, we are now seeing high quality banks issuing 1 year certificates of deposit at c.6.75%. To us, this is ample compensation taking into account any further additional tightening.

As the saying goes – don’t fight the central banks, especially at 5.40% yield for a 77 day weighted average life.