Since Russia’s attack on Ukraine, China’s diplomats have been keen to stress their strengthening strategic ties:

“No matter how the international landscape may change, China will continue to strengthen strategic coordination with Russia for win-win cooperation, jointly safeguard the common interests of the two countries and promote the building of a new type of international relations and a community with a shared future for mankind.” A statement released by the Chinese foreign ministry in late April.

In fact they are willing to put their money where their mouth is, with Chinese companies actively bidding for Russian assets being sold by western companies. For example, China’s state run energy companies are said to be in talks with Shell to buy its Russian stakes.

What is this going to mean for future relations between China and the West?

We already know that US relations with China soured some years ago when Trump put in place tariffs on Chinese goods. It’s worth noting this had bi-partisan support at the time and remains in place with seemingly no going back. China-US relations remain under pressure on many fronts other than trade.

Europe has learned the painful way that such a dependence on Russia built up a huge liability. Until recently, Europe was on a similar path with China, look no further than the 16+1 forum – a cooperation between central and eastern European countries and China. Opinions are now clearly souring given the cosiness of China’s relationship with Russia and Beijing’s refusal to condemn the invasion of Ukraine.

What does all this mean for markets?

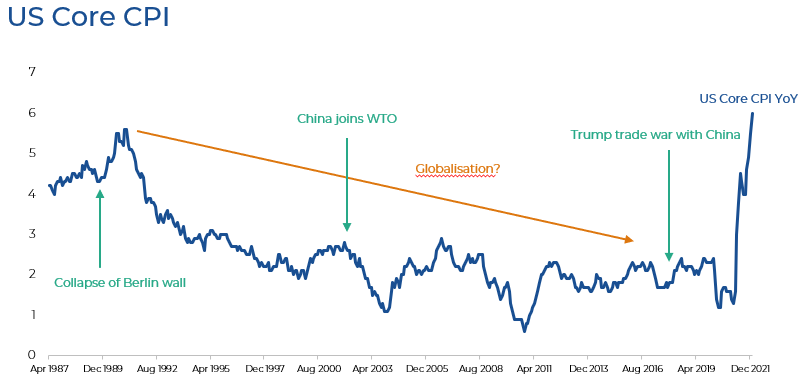

China has been pivotal in the last 3 decades in driving globalisation, which has in turn kept inflation low.

Source: Bloomberg 30.04.1987 to 28.02.22

Given the swift departure of companies from Russia of late, we suspect those same companies and indeed countries that are heavily dependent on supply chains in China and by extension Taiwan too, will be making plans to shift some of this production back home. Semiconductors are a good example of this. Whilst globalisation has been disinflationary, deglobalisation and a shift away from China are likely to have the opposite effect. This fracturing of supply chains may well keep inflation elevated for years to come.