Whilst ESG scores are supposed to represent strong Environmental, Social and Governance credentials, S&P’s latest update to the S&P ESG Index has firmly cemented the topic as a grey area for investors.

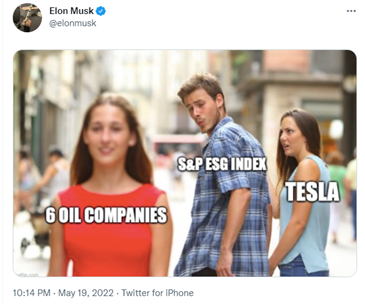

Tesla, the only pure mass market electric vehicle provider, has been unceremoniously kicked out of the ESG index, whilst those such as oil majors Exxon, Marathon Oil and Baker Hughes are included in the list, with some arguing this makes a mockery of the budding asset class and much to the chagrin of Mr. Musk himself.

Source: Twitter 19.05.22

So what should investors expect to see in their “sustainable” funds? If your sustainable portfolio was full of Exxon, which according to S&P is in the top ten for ESG, you may feel a little confused.

As a result of the uncertainty on the definition of sustainability, the FCA recently launched their Sustainability Disclosure Requirements discussion paper in their attempt to ensure consistency on the back of claims of “green washing” from a number of funds. They themselves note in a more diplomatic tone that “there is a risk of harm if the market responds to rising demand without adequate regulatory checks and balances” and have given themselves the remit to enhance both transparency and trust in ESG and sustainability products.

With that in mind, and as conscientious market participants, we need to ensure that we are treading firmly on the right side of the line. As a result, when investing in companies, there clearly has to be red lines and there has to be process and due diligence. But it is also clear that we cannot forget the most important element, that of common sense.

In the Fixed Income team at Premier Miton we combine strict process with pragmatism and sense checks. As a process, we do not buy those companies who are reliant on oil, coal or tobacco for their profits, and we use third parties to screen out the worst of the worst on all three of the E, S and G components. As a further belt and braces approach we look to screen out those companies that are deemed to have breached the UN Global Compact principles.

In addition to all of this, we also demand that common sense prevails. Assuming a company passes all of our filters, we ask, does it really feel right to invest in, or fund a particular company. Whilst a screened out company cannot jump into the investable world, a company that hasn’t been screened out certainly can be demoted into the un-investable sphere.

Names such as Granuul, the Estonian biomass or wood pellet producer, pass our ESG threshold on third party scoring alone. However, energy production on biomass remains contentious given the levels of greenhouse gasses released, let alone the reported side effects on health (increased impact on bronchitis) as a result of burning the fuel. This is a great example of where the company may be labelled green, but one which fails to pass the sense check.

We are looking to fund a positive future and to invest in companies with strong ESG credentials whilst also supporting companies’ transition away from fossil fuels. The principles are clear.

As it happens, both Tesla and Exxon fail to pass our stringent ESG screens and we won’t be investing in either until they do. But does Elon have a point to his frustration? He almost certainly does…