“Whatever it takes” was uttered by Mario Draghi in 2012 in an attempt to put an end to the European sovereign debt crisis. In the process it provided the backstop the market was looking for and provided a suitably accommodative monetary policy to support European government bond and European credit markets.

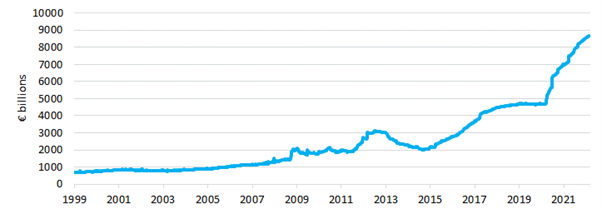

It can be argued the announcement helped to save the Eurozone itself. With it though, came monetary policy that reduced the deposit rate to a negative 50bps and injected abundant liquidity into markets. The consequence of such policy is much discussed, but it certainly delayed the much needed creative destruction and ensured zombie companies have been able to continue to refinance at lower and lower rates. In 2012, the ECB’s balance sheet was just over €3tn in assets, but has climbed since to close to €9tn.

Source: Bloomberg, 01.01.1991 – 04.03.2022.

Despite trillions of new monies flowing into the economy since 2012, growth remained low, whilst inflation continued to undershoot the ECB target of 2%, until the monetary largesse was met with fiscal largesse from governments during the pandemic.

The ECB has continued to be the most dovish major central bank as we come out of the pandemic despite recent data points being significantly in excess of their own targets. Eurozone CPI is greater than 5% whilst the Eurozone producer price index has more worryingly tipped the scales in excess of 20%. We expect CPI to rise materially in the coming months, with the current Russian invasion of Ukraine only exacerbating this dynamic further.

The ECB is the last of the major central banks to curtail their quantitative easing programs and the guidance for future tightening is “gradual”. The reasons why are clear.

Sovereign Solvency

The Eurozone is made up of 19 diverse economies each with their respective balance sheet health. The mighty Luxembourg with a debt to GDP ratio of 25% at one end of the scale and Greece the wrong side of 200% at the other and Italy at 160%. Government bond purchases through the monetary stimulus from the ECB has had the effect of reducing the borrowing costs of these more profligate southern states versus their more conservative neighbours – see Germany. The borrowing “spread” between those of Italy and Germany were in excess of 4.2% in 2012, but as a result of the continued support from the ECB, reached a low of below 1% during 2021. This spread has climbed as the ECB looks to end its QE program and is now greater than 1.5% and question marks remain at what spread an investor would need to take the credit risk of Italy in an environment of less central bank support because of the presence of inflation?

The ECB have the unenviable task of trying to tighten financial policy whilst maintaining solvency for their weakest members, all the while inflation pressures continue to be elevated.

Hard times and soft credit

As a consequence of the ECB stepping into the credit markets through their Corporate sector purchase programme (CSPP) and Pandemic emergency purchase programme (PEPP), credit spreads have remained relatively benign. In 2021 the ECB bought circa 60% of net issuance from eligible investment grade corporates – a huge number. These programs are being wound down this year which begs the question who will be the buyers to make up for the ECB dropping out of the market, and more importantly, at what level will they buy?

We have previously written how the economics of the European economy should be strong this year and we are looking to take advantage of opportunities, but it is without doubt that the technical backdrop in the financial markets is increasingly trickier as central banks step out of the market. Credit spreads will likely remain under pressure as a result, despite the significant widening we have already seen play out this year. Those zombie companies, who have been able to survive with ever easier financial accommodation, may now struggle to refinance with less liquidity and tighter financial conditions.

How do we trade it?

In the Premier Miton Strategic Monthly Income Bond Fund we are focused on short maturity debt, where we have some certainty it will generate a positive total return for the year and thus will be insulated from volatility in both the credit and rates markets. The fund looks to offer a lower volatility for investors, whilst considering protective strategies from increasingly erratic markets.