For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Somebody said this to me recently and it got me thinking. What is the age of the typical investor and what exactly are they looking for?

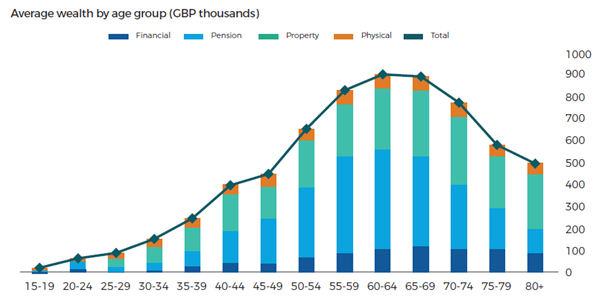

If we take a look at where the savings are held in the UK, we can see that the 50+ age bracket is where most of the wealth is held, much of it in pensions and other financial investments as well as housing:

Source: Bank of England speech ‘Running out of room: revisiting the 3D perspective on low interest rates’ 26.07.2021. UK Wealth and Asset Survey and Bank calculations. Notes: Chart shows weighted average wealth by age group from round 6 of the UK Wealth and Asset Survey. This data was collected between 2016 and 2018.

As we get closer to retirement, we are advised to invest more in fixed income versus equities to reduce portfolio volatility. Post-retirement, we clearly want low-volatility income generating assets to provide a stable income. When we look at the chart above, most of the wealth is in this cohort, requiring lower volatility income generating assets.

Fixed income yields are not only better now in nominal terms, but they are also getting better in real terms too

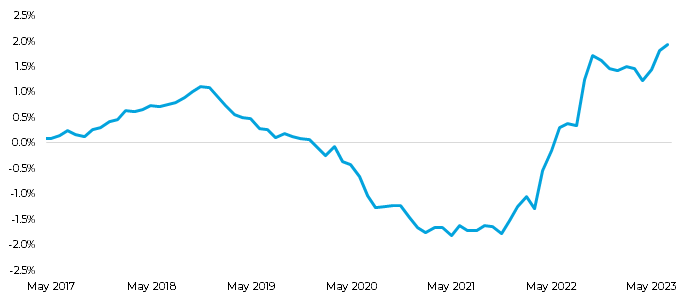

In the decade before and also during the pandemic, investing for low volatility income was actually quite hard to achieve – we had to take on large amounts of risk to get any type of income at all because of zero interest rate policy and quantitative easing. How times change! Investing is getting easier. We’re now getting better returns from safer assets and there is no better example of this than looking at real yields:

US Real 5 Year Yield

Source Bloomberg 31.05.2017 to 31.07.23. Past performance is not a reliable indicator of future returns.

With real yields in the US approaching 2% and those in the UK rapidly moving in the same direction, we are being paid a good return for being in safer assets over and above medium-term inflation expectations. A reminder that real yields are the yields on offer at a particular point in the government bond yield curve, (in this graph it’s 5 years, using 5 years as a sensible investment time horizon) minus average inflation expectations over the same time period. Times have indeed changed! We are now getting more return for less credit risk and less volatility. Investing for relatively low volatility income is getting much easier.

Fixed-income investing is all about yield per unit of risk

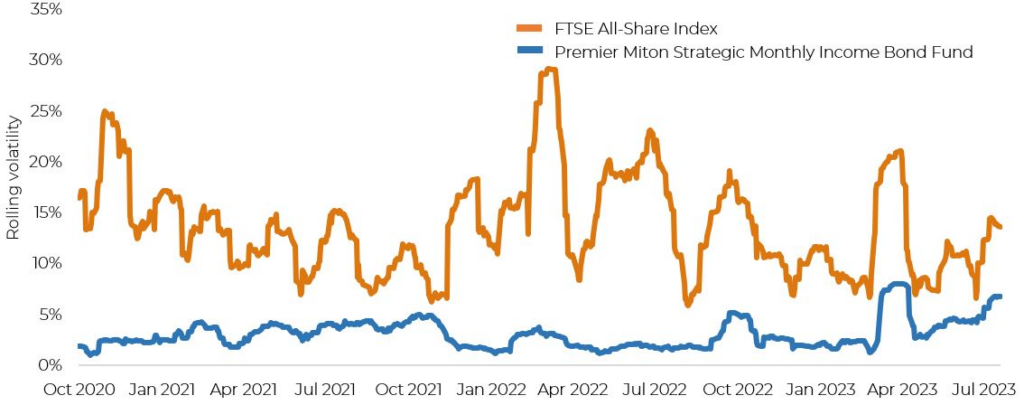

Whilst volatility has picked up recently in fixed income, which is normal during sell-offs, it is still well below the volatility of equity markets. There’s no better example of this than of the Premier Miton Strategic Monthly Income Bond Fund versus the FTSE All-Share Index:

Premier Miton Strategic Monthly Income Bond Fund versus the FTSE All-Share Index

Source: Bloomberg. Volatility taken on a weekly basis 31.10.2020 to 31.07.2023.

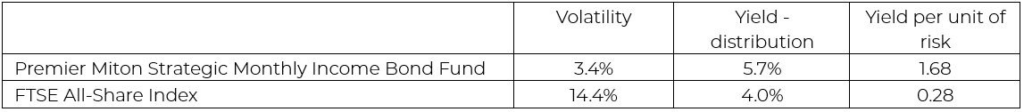

Source: Premier Miton & Bloomberg, underlying yield based on class C income shares, as at 31.12.2022. See Important information for further details.

We can see that the volatility of the fixed income fund is a fraction of that in equities and as a result, the yield per unit of volatility is many times that of equities. The yield used above for the fund is the distribution yield, if we use the yield-to-maturity which includes the pull-to-par of the bonds, the yield per unit of volatility jumps to 2.3% based on a yield on the fund of 7.7%

We expect this relatively high yielding environment to continue

Given the mix of ongoing heavy supply in government bond markets, high fiscal expenditure and above target inflation, we expect to continue to receive relatively high yields from the safer ends of the bond market over the medium-term. And by safer we are referring to government and investment-grade corporate bonds. We’ve expressed our dislike for highly leveraged high-yield companies here in the past and think this environment of higher returns from safer assets will continue to pile the pressure on high-yield companies as they refinance debt at higher rates. Indeed, high-yield along with other forms of riskier assets will need to reprice if safer forms of bonds continue to yield these levels for some time to come.

In conclusion, the current environment is one which is far more favourable to those seeking low-volatility income-generating solutions than it has been for many years – what else do you need?