By creating pounds, dollars, euros or any other currency, the world’s central banks stimulate economies by buying government bonds or other financial assets such as corporate bonds in order to lower the market cost of borrowing money, much the same as reducing interest rates. This is quantitative easing.

Quantitative tightening is the reverse of quantitative easing. In essence, it’s the destruction of currency by selling assets into the market and then cancelling those funds received. In theory, raising the cost of money in the market, the same as increasing interest rates.

Quantitative tightening is expected to start in the US in May, after last night’s Fed minutes indicated as much. Incidentally and somewhat less importantly because of the smaller size, it’s already started in the UK. But what does this mean for us in financial markets?

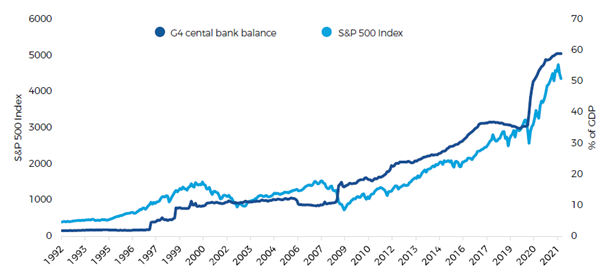

Quantitative easing was very positive for financial assets – by expanding central bank balance sheets and pumping additional “liquidity” (i.e. additional funds) into markets, it encourages risk taking. It encourages investors to seek additional returns outside of government bonds. That’s why we get the chart of truth:

S&P 500 Index versus central bank balance sheets

Source: Bloomberg, data from 16.03.1992 to 28.02.2022.

As we enter the age of quantitative tightening, as investors we should keep this chart in our minds at all times. It is a reminder that now is not the time to take on excessive amounts of credit risk. The easy money has been made and now we need to be more discerning. We are moving from an environment of abundant liquidity in which the market “buys the dip” to one in which there is less liquidity and it “sells the rally”. You may have heard the saying that QE floats all boats, in other words, even seemingly weak companies are able to survive, borrow funds and prosper. When QT kicks in, the opposite is true, the market starts to pick off and punish the weak companies. Highly levered companies, those getting squeezed by input costs and suffering margin compression, those with diminishing liquidity are not the place to invest in an environment of QT – we are currently keeping credit risk and duration in the fixed income funds relatively low.