For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Greasing the wheels of commerce

I do not know about you, but I haven’t been able to borrow any extra money for the last few months and I am starting to run out of cash. I have been carrying on my normal spending patterns though and throughout paying my existing debt and maintaining my lifestyle as per normal. All my existing creditors have been receiving my debt repayments and using those payments to fund new loans for businesses and consumers up and down the country, or in colloquial parlance “greasing the wheels of commerce.”

Dollar liquidity and financial markets

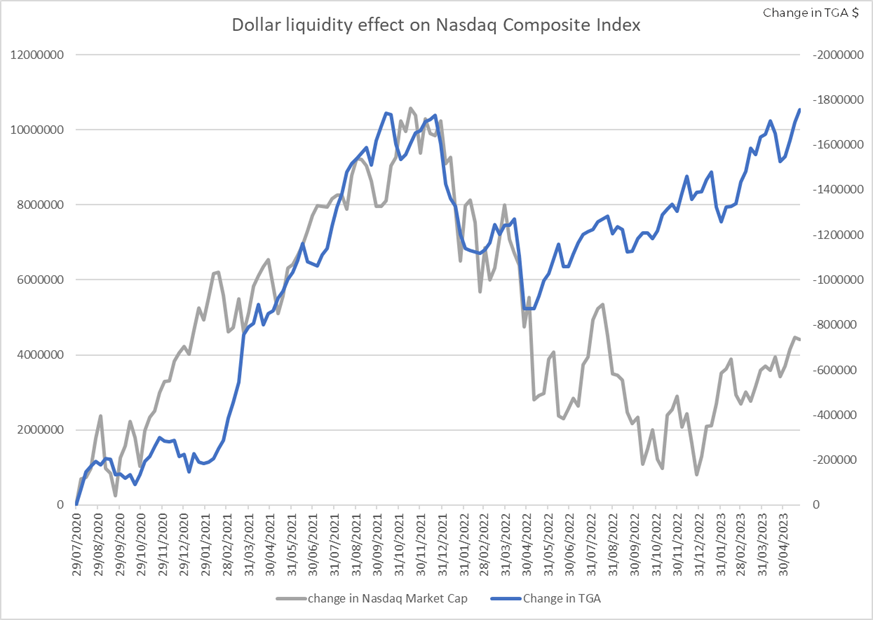

So going back a step. At the end of July 2020, the US Treasury held a balance of $1.8trn in their Treasury General Account (the “TGA”) – think of it as the US petty cash account. Then over the last three years they put that money back into the economy and importantly for investors, back into the market. By December 2021, that balance had shrunk down to a “mere” $85bn, essentially $1.7trn had been put into the economy. And when money goes into the economy, it usually ends up in the financial assets.

Source: Bloomberg data from 01.07.2020 to 30.05.2023

The change in the TGA was almost perfectly correlated to the NASDAQ Composite index (which we are using as representative of financial markets) in the chart above, until May 2022 when they diverged. The index has fallen or “underperformed” since.

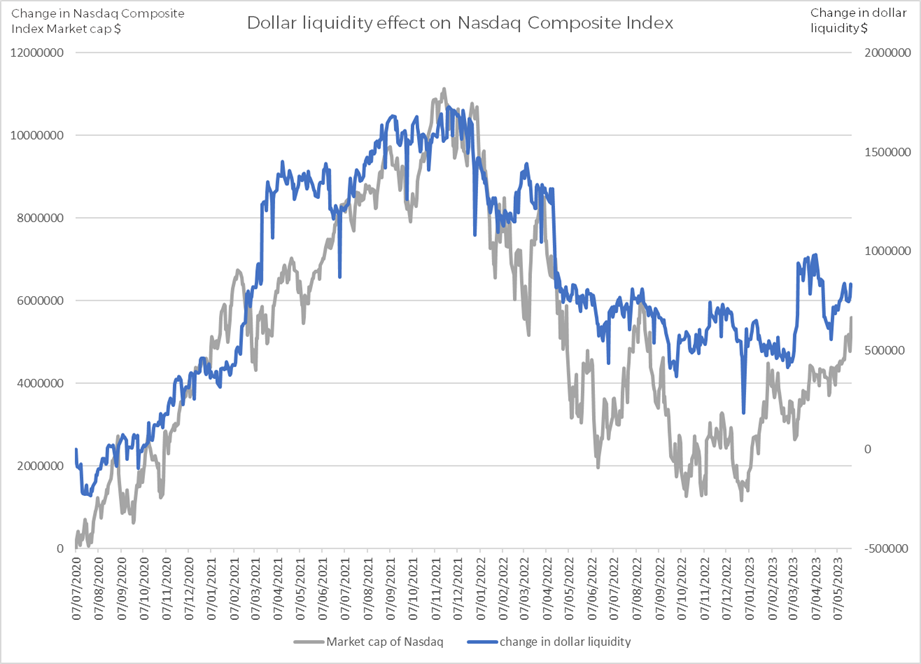

That timing is significant, Quantitative Tightening started on June 1st, 2022, Initially running off $47.5bn a month of the Federal Reserve balance sheet before ramping up to $95bn a month thereafter. If you throw in the Reverse Repo facility which negates circa half the Quantitative Tightening effect (a topic for brevity we will leave to another blog) then this would be a great approximation for the changes in total dollar liquidity in the economy, and as a result, in the market.

Source: Bloomberg data from 02.07.2020 to 30.05.2023

Quite the graphic, quite the correlation.

So, what does it all mean now with the debt ceiling about to be raised?

The Treasury have indicated that once the deal has been finalised, they would like to get the level of the TGA up to a balance of $600bn from pretty much zero as we stand today. In fact, in their May release, they stated that they expected to raise net cash of $733bn. Quite a sum.

Someone is going to have to fund this, and it will drain substantial liquidity from the financial markets. This level of issuance will mean that there is less money for lending to business, less money “for greasing the wheels of commerce” and less money for alternative investment. Essentially in all likelihood it will “crowd out” riskier investments – after all, risk assets are priced over the US rates market, these T-bill issues must be bought.

And after all, if you are demanding 5% from the US Government what do you demand to be paid from a small and risky business?

The initial euphoria of the US not defaulting may not last long in the markets. With inflation remaining sticky, it will be difficult for the Federal Reserve to curtail Quantitative Tightening, let alone reduce interest rates to ease the pressure gauges in the financial markets. The euphoria may not last long at all.