It may not feel like it, but investing is getting much easier. It is now possible to get better returns and take on less risk. Whilst inflation is at eye watering levels at the moment, it will not remain there and over any reasonable investing time horizon (i.e. 3-5 years) things are really looking up.

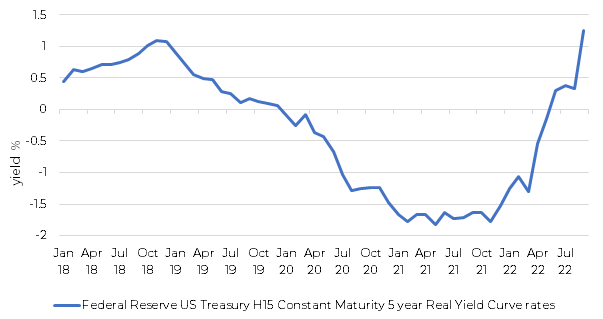

TINA is dead and buried

A couple of years ago, when monetary policy was extremely accommodative, investing was really hard going. Shoulders were shrugged as we realised there was no alternative (a.k.a TINA) but to take on a lot of risk. Negative real rates were driving investors into riskier and riskier assets at a time when fiscal and monetary policy was extremely loose. In other words, there was an awful lot of money chasing assets in order to get a positive real return.

5 year real rates are now positive

Source: Bloomberg 31.01.2018 – 30.09.22

Things have changed rapidly. We now have solidly positive real (inflation expectation adjusted) government bond yields over a reasonable investment time horizon. By the time we add on investment grade credit spreads, then the real return from safer assets comfortably outstrips inflation expectations.

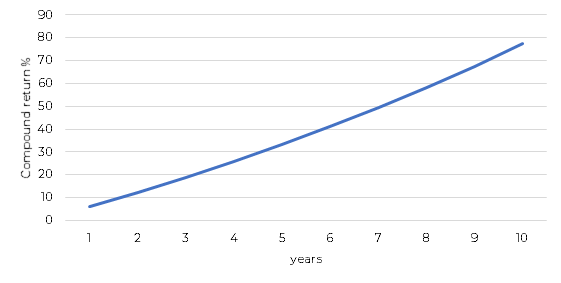

The power of compound interest

Taking a selection of short duration investment grade bonds to give a flavour of the returns on offer, we can see that the likes of well rated names such as Rothesay maturing in 2025 yielding 7.6%, TP Icap maturing January 2024 at 8.8% and Admiral Insurance bonds maturing in 2024 at 7.6% (source Bloomberg as at 19.10.22).

At an index level, the sterling investment grade index is yielding 6.58% as at 19.10.22 and compounded returns over an investable time horizon look very attractive

Compound return at a yield of 6.58%

Source: Bloomberg Sterling Aggregate Corporate ISMA Yield to Worst as at 19.09.22.

Safer assets, yield and compound interest

How times change! A few years ago it was hard to trumpet the power of compound interest because the reality was fixed income investors had to take on lots of risk in high yield companies in order to get a yield worth compounding! Well now that government bonds offer a solidly positive real return and investment grade is now high single digit percentage yields, the concept of compound interest from fixed income is alive once again offering excellent returns from safer assets.