So it’s that time of the year, a great opportunity to reflect, relax and rejuvenate as the summer months bring a sense of calm to the markets and we all go on holiday to recharge…err…who am I kidding! As we all know, this is no typical year and no typical summer and as active investors we need to continue to be on our ‘investment toes’ as well as on the beach.

Since my last Great Debate on Liquidity, we have seen England cautiously ‘celebrate’ freedom day, global inflation data continue to spike to the upside, an increase in the Delta variant causing global growth to be questioned and the biggest news of all…England nearly brought it home! So in part 1, we discussed how a large percentage of bonds hardly trade with bonds ‘locked’ away. Now we need to discuss which bonds are more likely to trade with a focus on the date of issuance as a significant factor. Even more than ever, it’s still important to talk about the liquidity of bonds in your portfolio as we do hit a summer grind, especially in the calm before the storm of corporate new issues in September.

The spirit of youth

Bonds come in all shapes and sizes with numerous characteristics but with all things being equal what is clear is that ‘younger’ bonds (those closer to the issuance date) will be more liquid than those that are more aged. Obviously factors such as size of issue, currency, maturity, seniority and ratings will all have an impact as well but understanding the age profile of your bonds can increase the liquidity of your portfolio.

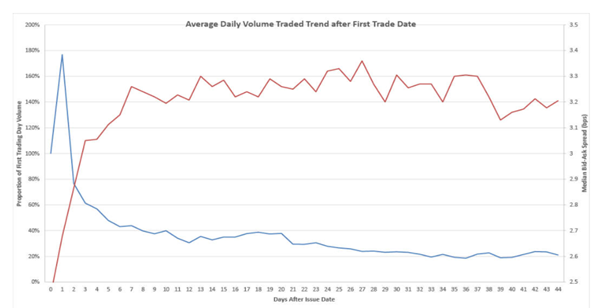

The table below demonstrates how the daily average volume on US investment grade bonds dramatically decreases after initially being issued. By day 45, the average daily volume has dropped to 20% of the volume traded on the original day of trading. What may seem a small factor in assessing liquidity may actually have a large impact on your ability to trade in the market. In fact, MarketAxess have analysed that the bid offer spread increases over this time which is a sign of declining liquidity. This relationship can have a major impact in terms of the performance of your portfolio.

Source: MarketAxess January 2020 – March 2021

As active investors, we believe in keeping our portfolios nimble and agile and where possible taking advantage of the discount to fair value of new issues and using the liquidity of younger bonds to enhance performance. However, it should be noted that a credit bond portfolio will always consist of a range of bonds which are close to and far from the issuance date as each bond is picked on its own fundamental merits. Older bonds can in fact show more price stability in times of stress and provide a good anchor for the portfolio. Although it’s important to be mindful there could be a limited number of buyers and sellers when needed and so a delicate balance of both is required to enhance the liquidity of a portfolio.

As a credit dealer, if you are unable to source your required inventory, being able to replace bonds with liquid alternatives is key. Having an understanding of a bond’s characteristics such as age since issuance in combination with other factors is vital when assessing how it trades in the market and giving an informed view to portfolio managers. The increase in the use of platforms and technology in providing available and substitute inventory data can also significantly help this process as well as your own market experience. There is no doubt trading volumes have decreased as we move into the peak of summer which is normal for this time of the year. However, with Covid headline risk causing volatility and the new issues deluge on the horizon, heading into the paddling pool with a glass in hand won’t be the only liquidity assessment that needs to be carried out.