Capital at risk. For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

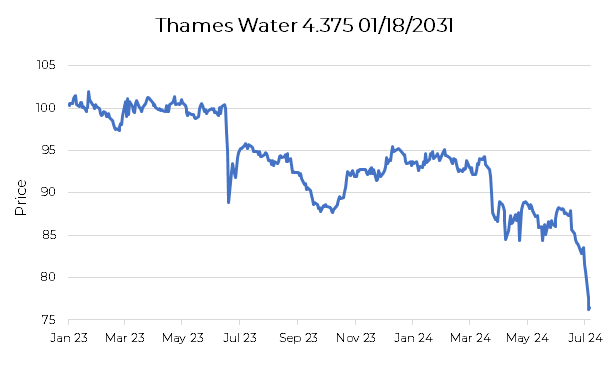

Being invested in Thames Water bonds must be just like being Indiana Jones getting chased by the torrent of water in the Temple of Doom – a rollercoaster ride, writes Lloyd Harris, Head of Fixed Income.

There’s just no getting away from the bad news, and when you do… there’s a cliff edge! Needless to say, in the Premier Miton fixed income team we don’t like wet rollercoaster rides like this one. Thames, to us, was not a good investment. We do not own it.

Thames Water is on the cliff edge

The cliff edge Thames faces is unavoidable. You may have noticed the flow (sorry, couldn’t help it!) of bad news has picked up recently.

Ofwat, the regulator, has this month told companies what they can earn for the next five years. It’s not going to be enough to save Thames, in our eyes.

Simply put, the company’s return on equity will be significantly below the cost of debt.

In order to survive, Thames requires more equity, and what equity investor in their right mind would invest in this company? The only way out, to make the company attractive to equity and debt investors alike, is to restructure the debt so there is much less of it.

Secondly, and very importantly, the credit rating agency S&P has just put Thames on review for downgrade to high-yield, indicating a downgrade could happen within weeks.

Thames is a whopper for the high-yield bond market. If downgraded, it would be one of the largest ever downgrades in Europe – in the top 10 globally and the largest ever UK non-financial.

Hence, there is likely to be significant forced selling from investment-grade sellers and little

buying, by comparison, from high-yield buyers.

Downgrade to high-yield to precipitate a restructuring

Any visit to high-yield is likely to be brief, because a high-yield water company, aside from the high cost of debt being an impediment to successfully running the company’s finances, will be at risk of having its licence revoked. A debt restructuring is likely to be relatively swift as a result.

To add to Thames’ woes, Ofwat have placed Thames into a “Turnaround Oversight Regime”, which reflects the group’s financial and operational challenges.

While some of the measures within the regime could be described as positive, net/net there’s nothing to sufficiently move the needle on the likelihood of a restructuring to our minds.

Bond market participants are the alligators lashing around at the bottom of the cliff

Understandably, recent price action has not been good and liquidity on the bid side has been largely non-existent. Spreads have moved significantly wider in recent weeks, and the water sector in general has traded poorly outside of Thames. Broader UK utilities have also underperformed.

Source: Bloomberg 12.01.2023 – 17.07.2024. Past performance is not a reliable indicator of future returns.

Riding the Thames log-flume has been a great way to lose money

Speculating on the size of the haircut to Thames bonds is not an investment – this is what the market is telling us. If it was, then spreads would have stabilised.

With the market technical picture being particularly poor for such a large, long-duration issuer moving from investment-grade to high-yield, our sense is spreads could move further still in the coming weeks and months before we reach a bottom.

Existing holders are unlikely to be able to exit before a restructuring, and all these holders have now is hope.

Potential for more restructurings: we do not like the sector

Once Thames gets downgraded and restructured, the market will move on to the next weakest water company, and so on. This is why we are happy to be significantly underweight UK water and UK utilities in general.