For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Refinancing hell

You can almost hear the gasps of those who have recently looked to refinance their mortgages, shocked about the increase in monthly payments they are having to make. At the half year update Lloyds bank said a third of their mortgage book was up for renewal by the end of the year. The refinancing together with consumers having to bear the brunt from the inflationary impact on their costs, will mean reverberations to consumer spending will be palpable.

Now whilst it is far from perfect, in the UK we do have a social safety net, whether it is the recent banks charter on mortgages or as far down the spectrum as food banks. Not great, but something.

If I look at those companies in the high yield market, those with relatively weak cash flows and weak balance sheets, they are also affected – just without a social net. Whether it be the inevitable slowdown of consumer spending impacting their revenues, inflation impacting their costs, wages or other input costs, it likely tightens margins. These, together with the gargantuan rise in finance costs, can result in the death knell being dealt to a number of companies.

Yield shock

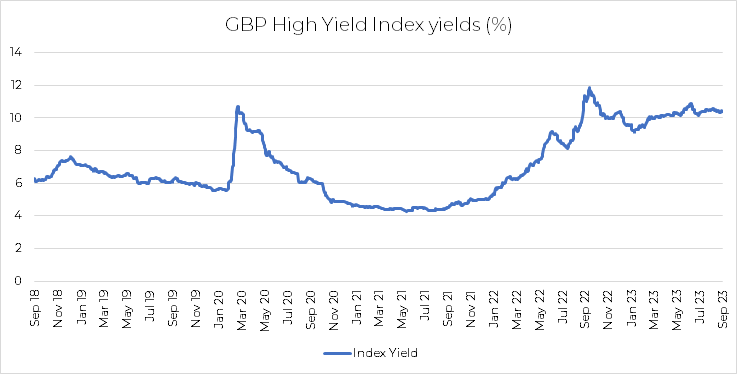

As crazy as it sounds today, the European High Yield Index yields bottomed out in September 2021 at a paltry 2.24%. Let that sink in. If you were a treasurer of a high yield company, it was like Christmas had come early. Central banks flooding the market with liquidity, fiscal policy supporting consumers and businesses. They never had it so good. The yield of that same index ended last week running in excess of 7% in Euros – for good measure the sterling index is in excess of 10% from a low of 4.29%!

Source: Bloomberg 30/09/2018 to 30/09/2023.

Investment grade issuers have similar issues. Yields have risen commensurately; however, investment grade companies’ maturities are traditionally longer than those of high yield companies. Also, almost by definition, they have stronger cash flows and stronger balance sheets so they can withstand an increase in finance costs, albeit become less profitable as a result. High Yield companies do not have that luxury.

One good example of many is perhaps Asda. In February 2021 they issued the largest bond in the sterling High Yield market. £2.25bn maturing in February 2026 – less than 3 years away at a coupon of 3.25%. Whilst not passing judgement on the company per se I believe this is a great example of a company that will have to withstand a huge rise in financing costs. Just that bond alone, if refinanced at current levels would add £157m of interest costs a year. That is a lot of additional bread and milk they will have to sell. The fact they have over £1bn of additional debt to refinance too certainly makes them susceptible and they will have to have stellar operating performance to continue to be a viable business with these eye-watering financing levels. Aldi and Lidl may have words to say about that too.

Lower risk, but still getting paid handsomely

Don’t get me wrong, there are opportunities in the High Yield markets these days, but that market is also littered with land mines of businesses that will fail the refinancing test. As a result, the Premier Miton Strategic Monthly Income Bond Fund has less than 10% in High Yield companies yet still yields in excess of 7.6% for the Yield to Maturity and 6.0% for the distribution yield. These days, you do not need to take a great deal of risk to get a real return.