"Toto, I have a feeling we’re not in Kansas anymore."

– L. Frank Baum

We’ve recently talked of the inflationary dynamics as we emerge from the pandemic. We’ve also talked about forward looking data and commentary being incredibly instructive as to what is actually being seen on the ground by businesses. Just like Dorothy in the Wizard of Oz, we were swept off our feet by the responses to this month’s Kansas City Fed manufacturing survey. For example:

These responses do not suggest inflation is solely due to base effects. It also doesn’t appear to be transitory and whilst the Fed and other central banks may be using this language in order to try to persuade the populous that inflation is temporary, expectations are unlikely to remain anchored in an economy with shortages!

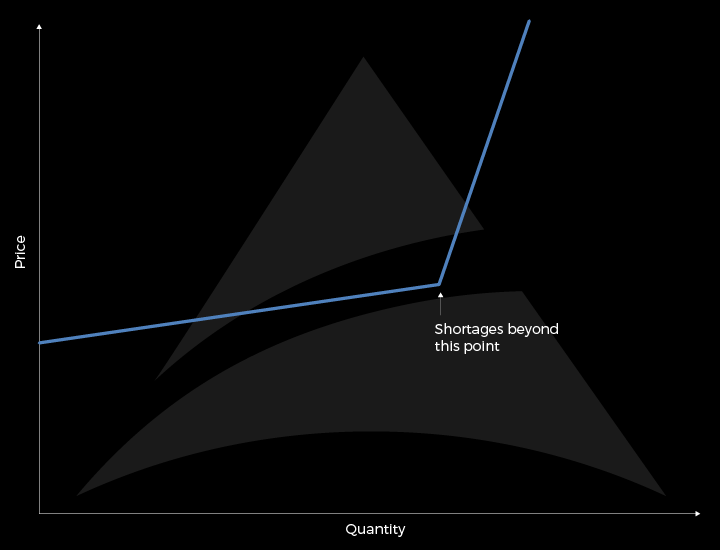

The kinked supply curve

This is an unusual phenomenon, particularly in the last few decades when seemingly there was a glut of supply of almost all goods versus a lack of demand. Well the pandemic has put an end to this through stimulus induced demand and virus induced supply disruption. Hence we see the re-emergence of the kinked supply curve, not commonly seen since the 1970s. The survey responses on the latest Kansas City Fed suggest we have, in many industries, gone past the kink in the supply curve which could lead to inflation to surprise materially on the upside for some time to come.

Incidentally, these survey responses for this month were part of a survey that included prices paid for raw materials compared to a month ago, posting a new survey record high for the second straight month, and prices received for finished goods also surpassed historical levels. Price indexes versus a year ago also posted record highs, with 98% of firms reporting higher materials prices compared to a year ago.

The upshot of all this is that as bond investors we prefer a short duration position and to avoid those companies most affected by an inflation induced margin squeeze.