For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

This is the headline we were greeted with this morning. In the first potential, optional redemption of an AT1 bond since the UBS purchase of Credit Suisse, UniCredit has elected to redeem or “call” its AT1 at the first call date.

As we’ve been saying since Credit Suisse, we think calls are now more likely than not for a number of reasons:

- Banks will want to show strength and calling bonds at the first call date is a great example of this.

- Banks are in a position to call – their total capital and core equity tier 1 capital levels are sound and well in excess of regulatory minima. Regulators look at these two capital ratios when deciding to allow a bank to call, not just the amount of AT1 they have outstanding. It is not necessary for a bank to issue a new AT1 to enable it to call an existing bond if it has sufficient excess core equity T1. Today we saw this in action.

- Regulators will be keen for banks to call bonds, once again as a show of strength. Never before has a regulator (FINMA, the Swiss regulator) been put on the naughty step by other regulators around the world as FINMA was with regards to how they dealt with the UBS purchase of Credit Suisse. Regulators from all around the world were keen to stress creditor hierarchy in the face of the Credit Suisse AT1 writedown, and also to reiterate the strength of their respective banking systems. Calls help in this regard.

- Regulators are keen for this asset class they created to continue to exist and there’s no better future for the asset class than to get back to normal market functioning with banks calling bonds at the first call date and new issuance kicking off again. We expect new issuance from large cap European banks soon.

- The regulator and banks in Europe have long bemoaned that their cost of capital is well in excess of that of US banks. One reason is the complexity premium attached to European bank AT1 which leads to it being more expensive to issue in comparison to US bank preference shares (US banks issue preference shares as AT1). Clearly it is highly undesirable for the cost of AT1 issuance for European banks to go up further, another reason to promote normal market functioning.

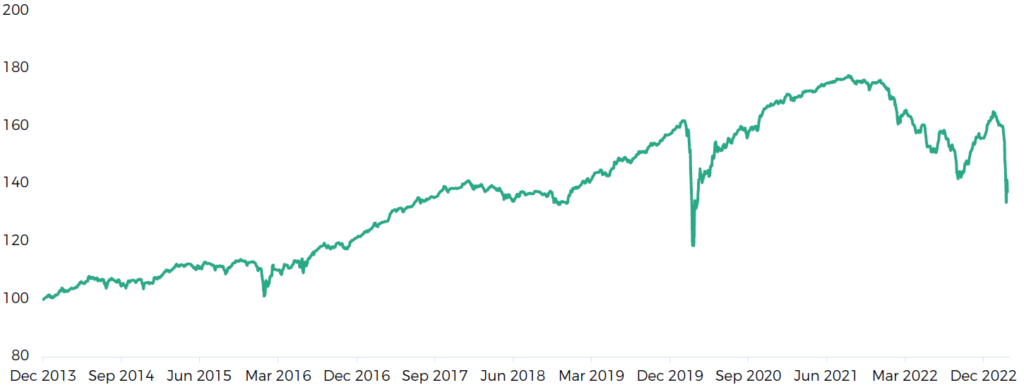

The called UniCredit AT1 was trading at mid-price of 98.4 prior to the announcement, a yield of 9.6%, it is now trading at a mid price of 100.2, a yield of 4.49%. We expect further calls, leading to further positive performance in the asset class, where sharp selloffs, such as that experienced recently are historically excellent entry points:

ICE Bank of America Contingent Capital Index – Total Return Index Value

Source: Bloomberg, data from 31.12.2013 to 24.03.2023. Source ICE Data Indices, LLC is used with permission.