Everyone’s favourite question at the moment, how do you position into the US election? Here’s what we think for fixed income:

Duration risk – keeping it short, expect curve steepening

Both candidates have policies that are inflationary and if anything, over the last few weeks those policies have become even more expansionary and inflationary than they previously were. New policies include, on the Trump side, tax cuts on overtime pay, social security benefits, auto-loan interest and state taxes. On the Harris side, new policies include tax credits for newborn children and home purchases.

But it’s the Trump side where things get really interesting. Across the board import tariffs of 10-20%, up from his earlier plan of 10%. 60% or higher on imports from China. Advisers to Trump maintain this is not inflationary. We think otherwise.

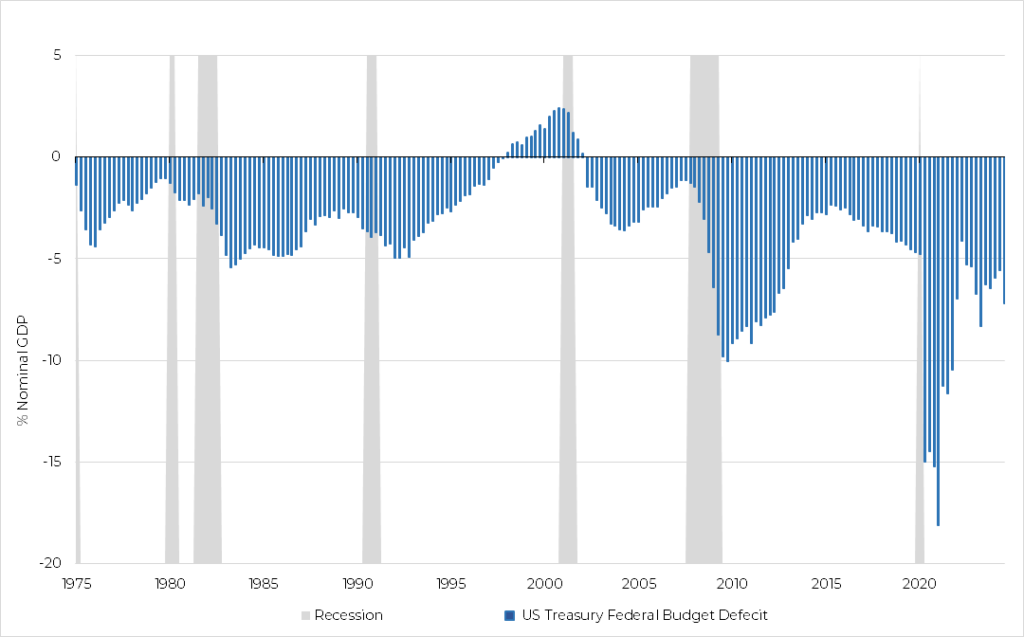

When we look at the sheer scale of the borrowing each candidate may put into action, the numbers are staggering. Trump’s economic plans are forecast to raise federal debt by double that of Harris, by some $7.5trn, yes a $7.5 trillion increase! It’s not like Harris’s economic plans amount to austerity either, forecast to increase debt by some $3.5trn. These are increases on an already large budget deficit by historical standards outside of a recession:

US Treasury Deficit as percentage of Nominal GDP

Source: Bloomberg/US Treasury, from 30.09.1974 to 30.09.2024

In short, there is no need to be running a great deal of duration here, especially at the longer end of the curve. The short end of the curve may well benefit from further rate cuts in the near term. Even though we expect a lower non—farms payroll number for October, the implication is that with such expansionary policies over the term of the next presidency any weakness in the economy will be short lived. Hence the longer dates should be weaker than shorter dates and the curve should steepen as a result.

Credit risk – keep it light

On the economic growth side of the equation, we think that both candidates are good for the economy given how expansionary their fiscal policies are. However, Trump’s policies are likely to create more volatility than Harris’s and there are clearly greater risks with Trump, given the sheer scale of the implied budget deficit – that it causes much much higher long term interest rates and this affects riskier assets, such as credit and equities.

It’s easy to go into these events such as an election, hedged and wedged without wholly thinking about how the market will react the other side and whether these hedges are indeed necessary. For credit, the reality is quite simple this time around. We are already trading at very tight levels of credit spread versus history, therefore we don’t need to be running a great deal of credit risk purely based on valuation because there isn’t a great deal to play for. The pay-off is asymmetric, no need to be a hero.

End of October/beginning of November shaping up to be potentially seismic for markets

On this side of the pond, we have the budget in the UK on October 30th, which from reports is going to be expansionary, potentially very expansionary with Rachel Reeves looking to give herself additional “headroom”. Then shortly after on November 1st we get the next non-farms report, which we expect to be lower due to the recent hurricanes. The US election is on the 5th Nov, the next Fed meeting is on the 6th and the Bank of England meets on the 7th. Strap yourselves in, bonfire night could be the least of the fireworks!